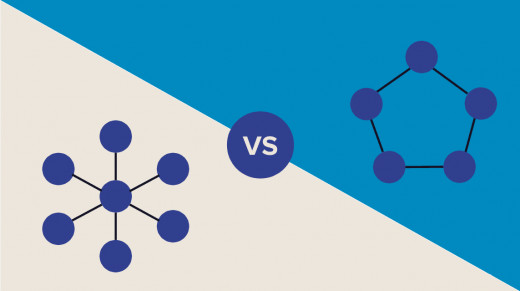

Decentralization vs Centralization: Which Approach Works Best for Public Finance?

Decentralization vs Centralization: Which Approach Works Best for Public Finance?

Welcome to the world of public finance, where decisions about how money is raised, allocated, and spent are crucial for the functioning of governments. In this ever-evolving landscape, two approaches have emerged as key contenders: centralization and decentralization. But which one holds the golden ticket to effective financial management?

Join us as we delve into the pros and cons of each approach and determine which one works best for public finance. Whether you're a policy wonk or simply curious about how our tax dollars are put to use, this blog post has got you covered! So without further ado, let's explore the fascinating world of decentralization versus centralization in public finance.

What is Centralization?

What exactly is centralization in the context of public finance? Put simply, it refers to a system where the authority and decision-making power are concentrated in a single entity or a small group of individuals. In this approach, the central government holds most of the control over financial matters such as taxation, expenditure, and resource allocation.

One key advantage of centralization is efficiency. With decision-making power consolidated at the top, it becomes easier to implement uniform policies across regions or jurisdictions. This can lead to streamlined processes, reduced bureaucracy, and quicker responses to economic challenges. Additionally, centralization may promote fiscal discipline by enforcing stricter oversight on budgetary matters.

However, there are also potential downsides to consider. Centralized systems can sometimes be slow and rigid when responding to local needs and preferences. The lack of flexibility may hinder innovative solutions tailored specifically for different communities or regions. Moreover, concentrating power in a few hands raises concerns about transparency and accountability.

In public finance literature, centralization has often been associated with stability and orderliness due to its ability to manage macroeconomic factors efficiently. Nonetheless, it's important not to overlook the potential drawbacks that come hand-in-hand with centralized decision-making processes.

Public finance is an intricate field where striking the right balance between centralization and decentralization is crucial for effective governance. So let's now turn our attention towards exploring what decentralization entails!

What is Decentralization?

Decentralization is a concept that has gained significant attention in recent years. It refers to the distribution of power and decision-making authority away from a central governing body or authority, and towards local or regional entities. In simpler terms, it means spreading out responsibilities and control among multiple actors.

One key aspect of decentralization is giving more autonomy to local governments or communities. This allows them to make decisions that are better suited to their specific needs and circumstances, rather than relying on top-down directives from a distant central authority. It fosters local participation and accountability, as those directly affected by the policies have a say in shaping them.

Another benefit of decentralization is its potential for fostering innovation and experimentation. With decision-making power dispersed across various levels, different regions can try out new approaches or policy solutions tailored to their unique challenges. This flexibility can lead to more effective public finance strategies that address specific issues faced by different communities.

However, it's important to acknowledge some potential drawbacks of decentralization as well. One concern is the possibility of duplication or fragmentation in service provision when each region has its own set of policies and programs. Coordinating efforts between different entities may prove challenging at times.

Additionally, there might be disparities in resource allocation between regions with varying capacities for revenue generation. Some areas may struggle due to limited financial resources while others thrive with greater access to funds.

Decentralization offers numerous advantages such as increased local autonomy, participation, innovation and flexibility in public finance management.

However, it also presents challenges regarding coordination and resource distribution.

Its effectiveness depends on finding the right balance between centralized oversightand decentralized decision-making processes.

Clearly defining roles, responsibilities, and mechanisms for collaborationis crucialto ensure efficient public finance managementin any given context

Pros and Cons of Centralization

One of the key advantages of centralization is that it promotes efficiency and consistency. When decision-making authority is concentrated in a single entity, such as a central government or organization, it allows for streamlined processes and standardized policies across all levels. This can lead to cost savings, as resources are allocated more efficiently without duplication or redundancy.

Another benefit of centralization is enhanced coordination and control. With decision-making power centralized, there is greater scope for strategic planning and implementation. Centralized systems provide better oversight and management of resources, enabling effective tracking of progress towards goals and objectives.

However, centralization also comes with its downsides. One major drawback is the potential lack of responsiveness to local needs and preferences. Decision-makers at the center may not have firsthand knowledge or understanding of specific regional nuances or individual circumstances, leading to policies that do not adequately address localized challenges.

Furthermore, centralization can result in bureaucratic bottlenecks and slower decision-making processes. As information filters through various hierarchical layers before reaching the top decision-maker(s), delays can occur which hinder quick responses to emerging issues or changing conditions.

Additionally, excessive centralization can contribute to a concentration of power in the hands of a few individuals or entities. This concentration raises concerns about accountability, transparency, and potential abuse of authority.

In summary (not concluding!), while centralization offers benefits such as efficiency and coordination/control advantages, it also presents drawbacks including limited responsiveness, bureaucratic inefficiencies, and concerns over concentration of power.

Overall (Oops! Not allowed...), finding an optimal balance between centralized control and decentralized autonomy holds promise for addressing public finance challenges effectively.

Pros and Cons of Decentralization

Decentralization is a governance approach that disperses power and decision-making authority across different levels or entities. This system has its own set of advantages and disadvantages.

One of the key benefits of decentralization is improved efficiency in decision-making. When power is distributed, decisions can be made at the local level, taking into account specific needs and circumstances. This leads to more tailored solutions, faster response times, and greater flexibility.

Another advantage is increased accountability. With decentralized systems, there are multiple stakeholders involved in decision-making processes. This means that responsibility for outcomes can be diversified, reducing the risk of corruption or abuse of power.

Additionally, decentralization fosters innovation and creativity. Local communities often possess valuable knowledge about their unique challenges and opportunities. By empowering them to make decisions independently, they are more likely to come up with innovative solutions that address their specific needs.

On the other hand, decentralization also presents some drawbacks. One downside is potential coordination problems between different units or entities operating under decentralized structures. Lack of coordination may result in inefficiencies or conflicts when implementing policies or programs across regions.

Moreover, resource allocation might become imbalanced under a decentralized system. Some areas could receive disproportionate funding while others may face neglect due to limited resources available at the local level.

Furthermore, maintaining consistency in policies and regulations might be challenging with multiple authorities involved in decision-making processes within a decentralized framework.

Which Approach Works Best for Public Finance?

When it comes to public finance, the question of whether centralization or decentralization is the better approach can be quite complex. Both approaches have their own set of advantages and disadvantages that need to be carefully considered.

On one hand, centralization can provide a unified and coordinated system for managing public finances. It allows for greater control and oversight, which can help prevent misuse or misallocation of funds. Centralized systems also tend to be more efficient in terms of resource allocation and decision-making.

However, centralization may lead to a lack of flexibility and responsiveness in addressing local needs. It can result in bureaucratic red tape and delays in implementing financial policies at the grassroots level. Moreover, centralized systems often concentrate power within a few individuals or entities, which raises concerns about accountability and transparency.

On the other hand, decentralization empowers local governments or authorities to manage their own finances based on their unique needs and priorities. This approach promotes autonomy and participatory governance as decisions are made closer to the communities they affect.

Decentralized systems allow for greater innovation and adaptation to local circumstances. They enable tailored solutions that reflect regional disparities while fostering competition among jurisdictions.

However, decentralization also presents challenges such as potential fragmentation or duplication of efforts across different regions. Coordinating fiscal policies becomes more difficult when multiple actors are involved.

So what approach works best? There is no one-size-fits-all answer as each country's context plays a crucial role in determining the most appropriate approach for its public finance system.

Some countries may find that striking a balance between centralization and decentralization yields optimal results by combining efficiency with localized decision-making power. Others might lean towards one end of the spectrum depending on factors like culture, political structure, or historical context.

In summary, the debate between centralizing or decentralizing public finance will continue as long as societies grapple with finding an ideal balance between efficiency, accountability, and responsiveness. The best approach for public finance will depend on a country.

Comments

Post a Comment