Successful Case Studies in Public-Private Partnerships

Successful Case Studies in Public-Private Partnerships

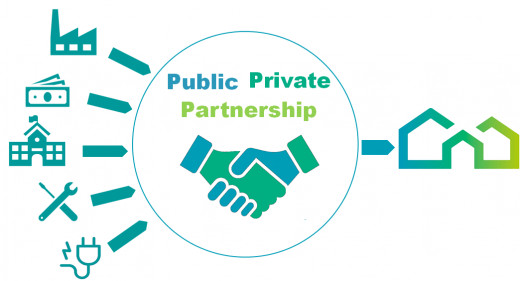

Welcome to our blog! Today, we're diving into the fascinating world of Public-Private Partnerships (PPPs) and exploring some truly successful case studies. PPPs have become a powerful tool for collaboration between government entities and private companies, unleashing immense potential for infrastructure development and innovation. From transforming transportation systems to revitalizing aging infrastructure, these partnerships have proven time and again that teamwork can achieve remarkable results. So, fasten your seatbelts as we embark on a journey through the triumphs of public-private collaborations!

What is a Public-Private Partnership (PPP)?

Public-Private Partnerships (PPPs) are dynamic collaborations between government entities and private companies. These partnerships bring together the strengths and resources of both sectors to tackle complex infrastructure projects that might be beyond the reach of either party alone.

In a PPP, the government typically provides regulatory oversight, while the private sector brings in expertise, funding, and efficiency. This unique combination allows for innovative solutions to pressing challenges in areas such as transportation, healthcare, energy, and more.

One key aspect of PPPs is risk-sharing. By sharing risks with private partners, governments can mitigate financial burdens and focus on their core responsibilities like policy-making. At the same time, private companies gain access to new markets and revenue streams through long-term contracts or concessions.

PPPs also promote accountability by establishing clear performance targets for all parties involved. The success of these partnerships depends on effective communication and collaboration throughout every stage - from project planning to execution and maintenance.

When properly structured and managed with transparency, PPPs have demonstrated their ability to deliver high-quality infrastructure projects on time and within budget. Through leveraging each other's strengths, public-private collaborations pave the way for economic growth while addressing critical societal needs.

The Benefits of PPPs

Public-Private Partnerships (PPPs) have gained significant attention in recent years as a strategy to address infrastructure challenges. The benefits of PPPs are vast, making them an attractive option for governments and private entities alike.

PPPs allow for the sharing of risks between the public and private sectors. By combining resources and expertise, both parties can mitigate potential financial burdens associated with large-scale projects. This risk-sharing aspect ensures that projects can move forward even in uncertain economic conditions.

PPPs promote innovation and efficiency. With private sector involvement, there is often a greater emphasis on finding innovative solutions to problems and optimizing project delivery. The profit-driven nature of the private sector encourages efficiency in all aspects of the project's lifecycle.

Moreover, PPPs offer increased access to funding sources that may not be available solely through government financing. Private investors bring capital investment to the table, reducing the burden on taxpayers while still allowing essential infrastructure development to take place.

Additionally, PPPs foster collaboration between public agencies and private companies. Through effective communication channels established during these partnerships, knowledge transfer occurs more readily – resulting in improved decision-making processes and ultimately better outcomes for communities.

By leveraging private sector skills and experience alongside government oversight, PPPs often lead to faster project implementation timescales compared to traditional procurement methods. Timely execution means citizens can benefit from improved infrastructure sooner rather than later.

In conclusion (not concluding), Public-Private Partnerships provide numerous advantages when it comes to addressing complex infrastructure needs efficiently. They enable risk-sharing arrangements while fostering innovation through collaboration between stakeholders from different sectors. Additionally, they widen access to diverse funding sources while expediting project delivery timelines – all contributing towards building sustainable communities for future generations.

Case Study 1: The Port of Miami Tunnel

The Port of Miami Tunnel is a prime example of a successful Public-Private Partnership (PPP) that has transformed transportation and commerce in Miami. This innovative project, which was completed in 2014, involved collaboration between the Florida Department of Transportation, Miami-Dade County, and private consortium MAT Concessionaire LLC.

One of the main objectives of this PPP was to alleviate traffic congestion in downtown Miami by providing an alternative route for trucks carrying goods to and from the port. The tunnel connects the MacArthur Causeway on Watson Island with Dodge Island, where the port is located. It consists of twin tunnels that are approximately four kilometers long and allow trucks to bypass city streets.

Thanks to this partnership, freight traffic no longer clogs up downtown streets, improving overall traffic flow and reducing air pollution caused by idling vehicles. Additionally, it has boosted economic growth by facilitating trade through faster and more efficient movement of goods.

The success of the Port of Miami Tunnel demonstrates how PPPs can effectively address infrastructure challenges while leveraging private sector expertise and funding. It serves as an inspiring case study for other cities considering similar projects to enhance their transportation systems and support economic development.

Case Study 2: The Tappan Zee Bridge

The Tappan Zee Bridge, located in New York, is a notable example of a successful public-private partnership (PPP). This project involved the construction of a new bridge to replace the aging Tappan Zee Bridge, which had become structurally deficient and congested.

The partnership between the New York State Thruway Authority and private consortium Tappan Zee Constructors proved to be highly effective. With an estimated cost of $3.98 billion, this massive infrastructure project was completed on time and within budget.

One key aspect that contributed to its success was the sharing of risks between the public and private sectors. By engaging with private partners who had expertise in large-scale infrastructure projects, such as design, engineering, construction, and finance, both parties were able to leverage their strengths for optimal results.

Moreover, innovative financing strategies played a crucial role in making this project financially viable. A combination of toll revenue bonds issued by the Thruway Authority and loans from federal agencies provided essential funding sources.

This PPP also emphasized sustainability by incorporating environmentally friendly features into the bridge's design. These included measures to reduce carbon emissions through efficient transportation systems and improved water quality management.

By leveraging each party's unique capabilities and resources while ensuring accountability through appropriate risk-sharing mechanisms, this PPP demonstrated how successful collaborations can deliver complex infrastructure projects efficiently.

As with any undertaking involving collaboration between different entities or sectors - challenges arose during implementation; however - proactive communication channels established from inception facilitated smooth decision-making processes throughout various phases of development

Case Study 3: High-Speed Rail in California

California is known for its traffic congestion and the need for efficient transportation options. In an effort to address this issue, the state embarked on a high-speed rail project that aimed to connect major cities with a fast and reliable mode of transportation.

The ambitious plan involved building a network of high-speed trains that would travel at speeds up to 220 mph, reducing travel time between San Francisco and Los Angeles to just under three hours. The project promised numerous benefits such as reduced greenhouse gas emissions, economic growth, and job creation.

However, the high-speed rail project in California has faced its fair share of challenges. One major obstacle has been securing funding for the project. The estimated cost of constructing the entire system has risen significantly over the years, leading to concerns about its financial viability.

Additionally, there have been legal battles and opposition from various stakeholders along the proposed routes. Environmental groups have raised concerns about potential impacts on local ecosystems, while property owners have fought against land acquisition for construction purposes.

Despite these challenges, some sections of the high-speed rail system are currently under construction or already operational. These smaller segments offer a glimpse into what could be possible once the entire network is completed.

It remains to be seen whether the California high-speed rail project will ultimately succeed in achieving its goals. However, it serves as an important case study in public-private partnerships and highlights both their potential benefits and inherent complexities when undertaking large-scale infrastructure projects like this one.

Why PPPs Fail

There are several reasons why public-private partnerships (PPPs) can fail to deliver the expected results. One common reason is a lack of clear objectives and accountability. When there is no clear definition of what success looks like or who will be responsible for achieving it, projects can easily veer off course.

Another factor that contributes to the failure of PPPs is inadequate risk assessment and management. If potential risks are not properly identified and addressed upfront, they can have serious consequences down the line. This includes financial risks, such as cost overruns or revenue shortfalls, as well as operational risks like delays or poor performance.

In addition, political interference can also undermine the success of PPPs. Political considerations may lead to changes in project scope or funding priorities, which can disrupt the progress and stability of a partnership. This highlights the importance of having strong governance structures in place to shield PPPs from undue political influence.

Furthermore, ineffective communication and coordination between public and private sector partners often hinders successful implementation. Misalignment in goals, expectations, and decision-making processes can create conflicts that impede progress.

Insufficient capacity within both public agencies and private companies involved in a PPP can hinder its success. Without proper expertise and resources on both sides, challenges related to project planning, execution, monitoring, and evaluation may arise.

Addressing these issues requires careful planning at every stage of a partnership – from project design to contract negotiations to ongoing monitoring – as well as continuous dialogue between all stakeholders involved.

By recognizing these potential pitfalls early on and taking proactive steps to mitigate them throughout the lifecycle of a partnership agreement could improve their chances for success.

Comments

Post a Comment