Creating a Favorable Investment Climate through Stable Monetary Policies

Creating a Favorable Investment Climate through Stable Monetary Policies

Welcome to our blog post on creating a favorable investment climate through stable monetary policies! In today's ever-changing economic landscape, it is crucial for countries to establish and maintain stability in their monetary policies. But what exactly does that mean? And why is it so important?

In this article, we will explore the concept of stable monetary policies, their significance in fostering economic growth, and how they contribute to maintaining a healthy investment environment. So grab your coffee and get ready to dive into the world of finance as we unravel the secrets behind successful monetary policy implementation!

What is a Stable Monetary Policy?

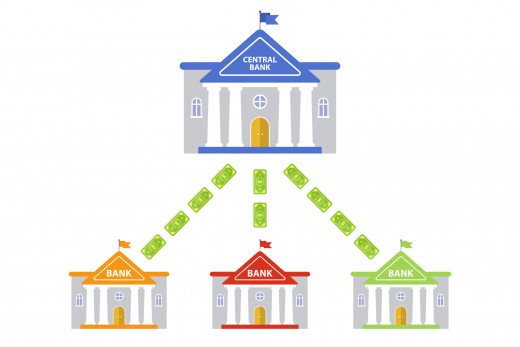

A stable monetary policy is a crucial aspect of any economy. It refers to the actions taken by a central bank or monetary authority to regulate and control the money supply, interest rates, and inflation in order to promote economic stability.

One key element of a stable monetary policy is maintaining price stability. This means ensuring that inflation remains low and predictable over time. By achieving price stability, it helps businesses and individuals make informed decisions about their spending, investments, and savings.

Another important aspect of a stable monetary policy is promoting sustainable economic growth. When there is stability in the economy, businesses are more likely to invest capital for expansion, which leads to job creation and increased consumer spending.

Additionally, a stable monetary policy helps maintain financial market stability. It reduces uncertainty among investors and encourages them to participate in various financial activities such as lending or borrowing funds.

To achieve these objectives, central banks use various tools such as open market operations (buying or selling government securities), adjusting reserve requirements for banks, or manipulating short-term interest rates.

The Importance of Stable Monetary Policies

A stable monetary policy plays a crucial role in fostering a favorable investment climate and driving economic growth. By maintaining price stability and promoting financial stability, it provides businesses and investors with the confidence they need to make long-term investment decisions.

Price stability is one of the key objectives of monetary policy. When prices are relatively stable, businesses can plan ahead without worrying about sudden spikes in costs or unpredictable inflation eroding their profits. This predictability encourages them to invest in new projects, expand operations, and create jobs.

Moreover, stable monetary policies help promote financial stability by reducing uncertainty in the financial markets. When interest rates are kept at reasonable levels over an extended period, it allows borrowers to plan their investments more effectively while also providing savers with a fair return on their investments.

In addition to promoting stability, a well-executed monetary policy can also address economic imbalances such as high unemployment or low inflation. Through its various tools like open market operations or adjusting interest rates, central banks can influence borrowing costs and credit availability to stimulate economic activity during downturns or rein in excessive inflationary pressures.

Central banks play a vital role in implementing these policies through independent decision-making processes based on data analysis and expert judgment. By setting clear objectives for price stability and employing appropriate tools, they ensure that monetary policies remain effective even during times of economic uncertainty.

To summarize briefly (without concluding), stable monetary policies are essential for creating an environment conducive to investment by providing businesses with certainty regarding prices and enabling them to plan future endeavors accordingly. Additionally, they promote financial stability by offering predictable returns on investments while addressing any underlying imbalances within the economy through targeted interventions when necessary.

Monetary Policy and Economic Growth

Monetary policy plays a crucial role in influencing economic growth. By managing the supply and cost of money, central banks can stimulate or restrict economic activity to maintain stability. When it comes to promoting economic growth, monetary policy focuses on factors such as interest rates, credit availability, and exchange rate management.

One way monetary policy supports economic growth is through interest rates. Lowering interest rates encourages borrowing and investment by making it cheaper for businesses and individuals to access credit. This stimulates spending and expands economic activity across various sectors.

Additionally, monetary policies that promote price stability help create a favorable environment for economic growth. Inflation erodes the purchasing power of consumers, reducing their ability to spend on goods and services. Through its control over inflation levels, central banks can ensure stable prices that support sustainable economic expansion.

Moreover, maintaining financial stability is another objective of monetary policy that contributes to long-term economic growth. Sound financial systems are essential for efficient allocation of resources and smooth functioning of markets. By implementing policies that regulate banks' activities and prevent excessive risk-taking, central banks foster confidence among investors which bolsters investment opportunities.

When implemented effectively with coherent objectives in mind, stable monetary policies can provide the necessary conditions for sustained economic growth by managing interest rates, controlling inflation levels,and ensuring financial stability.

The Relationship Between Inflation and Interest Rates

The relationship between inflation and interest rates is a crucial aspect of monetary policy. When inflation rises, central banks tend to increase interest rates as a means to curb excessive spending and keep prices stable. On the other hand, when inflation is low, central banks may lower interest rates to stimulate borrowing and investment.

Higher interest rates make borrowing more expensive for businesses and individuals. This reduces consumer spending and slows down economic growth. It also increases the cost of financing for businesses, which can discourage investments.

Conversely, lower interest rates encourage borrowing by making it cheaper. This stimulates consumer spending and boosts business investment in new projects or expansions. These measures aim to promote economic growth while keeping inflation at bay.

As such, central banks play a critical role in maintaining price stability through their control over interest rates. By carefully monitoring changes in inflation levels and adjusting policies accordingly, they strive to create an environment conducive to sustainable economic expansion.

There is an intricate relationship between inflation and interest rates that directly impacts both consumers' purchasing power and businesses' investment decisions. Central banks use this link as a tool to facilitate economic growth while guarding against the dangers of runaway inflation.

What are the Objectives of Monetary Policy?

Monetary policy plays a crucial role in shaping the economy, and its objectives are of utmost importance. The primary objective is to maintain price stability, which means keeping inflation low and stable. This ensures that the value of money remains relatively constant over time.

Another key objective is promoting sustainable economic growth. By influencing interest rates and credit availability, monetary policy can stimulate investment and consumption, leading to increased economic activity.

Additionally, monetary policy aims to stabilize financial markets by ensuring their smooth functioning. Central banks monitor market liquidity and respond accordingly to prevent disruptions that could negatively impact the overall economy.

Moreover, maintaining full employment is an essential goal of monetary policy. By managing interest rates and controlling inflation expectations, central banks can support job creation and reduce unemployment rates.

Furthermore, exchange rate stability is also an objective of monetary policy for countries with flexible exchange rate regimes. Stable exchange rates promote international trade by providing certainty for businesses engaged in global commerce.

The objectives of monetary policy are interconnected as they seek to create favorable conditions for sustained economic growth while maintaining price stability and addressing various macroeconomic challenges. Through effective implementation of these objectives, central banks contribute significantly towards creating a conducive investment climate that benefits both individuals and businesses alike.

How does the Fed Conduct Monetary Policy?

The Federal Reserve, commonly known as the Fed, plays a crucial role in conducting monetary policy in the United States. So how does the Fed navigate this complex task?

One of the key tools used by the Fed is open market operations. This involves buying and selling government securities to influence the level of reserves in banks. By increasing or decreasing these reserves, they can effectively impact interest rates and stimulate or cool down economic activity.

Another method employed by the Fed is adjusting reserve requirements for banks. By changing the amount of money that banks are required to keep on hand, they can control how much lending takes place within an economy. Lowering reserve requirements encourages more lending and boosts economic growth.

Furthermore, the Fed also utilizes its ability to set short-term interest rates through what is known as the federal funds rate. This rate serves as a benchmark for other interest rates throughout financial markets and has a direct effect on borrowing costs for businesses and consumers alike.

Additionally, forward guidance is another tool employed by the Fed to communicate their intentions regarding future monetary policy decisions. By providing clear guidance on their objectives and expected actions, they aim to shape market expectations and influence long-term interest rates.

While not directly related to conducting monetary policy itself but still important nonetheless is transparency. The Fed regularly communicates its decisions and rationale behind them through public statements and press conferences. This helps maintain trust in their actions among market participants.

Through various mechanisms such as open market operations, reserve requirements adjustments, setting short-term interest rates like federal funds rate along with forward guidance communication strategies plus maintaining transparency; The Federal Reserve skillfully conducts monetary policy ensuring stability in our nation's economy without compromising growth potential!

Comments

Post a Comment